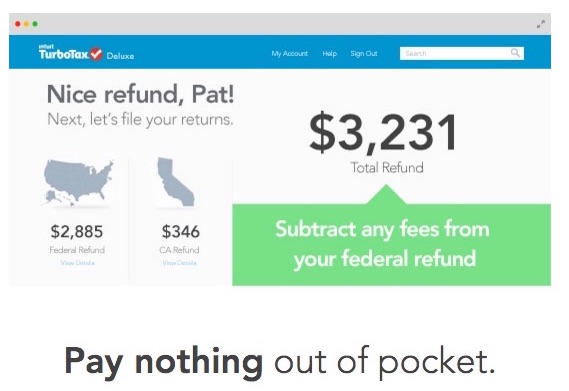

How soon can I get my tax refund advance? Our tax preparation services allow us to deduct our preparation fees directly from your federal tax return so that you don't have to pay anything upfront. No, you don't have to pay the tax preparation fees up front. Do I have to pay the tax preparation fees up front?

#Turbotax advance refund reviews free

Go into a store near you for a free estimate. This price includes electronic filing of both federal and state taxes.Īdditional fees are charged for any other forms needed to complete the tax return. Our tax preparation fees start as low as $29.95 for the 1040 form. If you want, you can also apply for a refund loan from Check City and get your tax refund money sooner. Just visit any of our stores with the documents you need and our friendly tax preparers will help you file your taxes on time this year. Tax Refund Advances at Check CityĪt Check City, you can take care of all your tax service needs without having to schedule an appointment in advance. If you set up an electronic payment, then you can potentially get your refund advance within 24 hours after filing.īy getting a tax refund advance, you can potentially get your taxes filed and receive your tax return all in one simple process. If you usually receive your tax return in the mail, then you could be getting your return money faster than if you waited for the check to arrive in your mailbox. You can get your tax return money sooner and the process goes hand-in-hand with getting your taxes filed and taken care of too! Get Your Refund Sooner There are many reasons to get a tax refund advance. They are a trustworthy service that will know how much you can afford to receive in a tax return loan.īecause Check City can also file your taxes for you, customers can rest assured their tax return projections, and thus their offered tax return loan amounts are dependable. In fact, tax loans from a tax preparation service can be easy and hassle-free, because your tax filing and tax return loan can be handled all at the same place with the same people.Ī company that files your taxes will also know what your projected tax return will actually be. Tax loans can often be found where tax preparation services are offered. Tax refund advances are a helpful loan because you don't necessarily need a bank account or an exceptional credit score for loan approval. This means that qualifying for a tax loan depends mostly on your anticipated refund, the amount you can expect to receive, and your status with the IRS. Tax loans are based on your anticipated refund amount from the IRS. Step 3: File your taxes and if you want, apply for a tax refund advance as well. If you are self-employed bring any receipts and expenses for your business. If you are wishing to itemize your taxes, bring your 1098 (home mortgage), medical bills, charitable donations, and non-reimbursed employee expenses. Step 2: Bring your W2’s, Photo ID, Social Security Cards for you and all your dependents, and any other important tax documents like 1099's. Tax returns may be filed electronically without applying for this loan. Rates and fees may apply.Ĭheck City also offers tax filing or tax preparation services where you can file your taxes year-round. The loan amount and applicable interest is deducted from tax refunds and reduces the tax refund amount paid directly to the taxpayer.īasically, customers can take out a loan with Check City and set up to repay the loan with their incoming tax refund. Instead of waiting for your tax refund to deposit into your account or arrive in the mail, you can set up a tax refund advance with Check City and get your money right away. The Refund Advance is an optional tax-refund related loan (it is not the actual tax refund) provided by MetaBank® at participating locations. The collateral or loan security for a refund advance is your tax refund from the IRS. Instead of waiting to get your tax refund, you can take out a refund advance and see those funds sooner. Get Earlier Tax Refunds with a Tax Refund Advance.Ī tax refund advance is a type of loan.

0 kommentar(er)

0 kommentar(er)